Want Us To Contact You?

Tax Preparation Services

Don’t wait until the last minute! New clients can save on our tax preparation services with our $140 special offer.

For many individuals, tax preparation and filing may seem like an overwhelming task. With the constant change to complicated Federal and State tax laws, along with life and financial changing events, this is a common feeling for a large majority of the population. Overlooking deductions and credits that you are entitled to can cost you money. Additionally, the accidental omission of items classified as taxable income can cost you even more down the road.

To take away the confusion, and unknown and to help you understand and prepare for the future, there is no substitute for utilizing the assistance of an experienced tax preparation service.

The current tax system offers many different variables that create different types of tax issues. These variables may include:

- 529 Education Plans

- Home Ownership

- Capital Gains or Losses

- Self Employment

- Taxes on Investments

- Receipt of Gifts Over a Certain Amount

- Inheritances

- Tax Credits and Deductions

- Taxes and Insurance

- Child Support and Alimony

- Retirement Plans

- 401 / IRA Contributions, Deductions, and Withdrawals

- Extensions, Back Taxes, and Late Filings

- and Many More…

We can help you understand how these variables affect your taxable income and prepare your tax returns according to the latest regulation.

Since 1955, Shapiro Tax Consultant has seen changes over the years and has always been ahead of the curve when it comes to preparing taxes and providing information for future planning. Rest assured, as your choice for tax services, Shapiro Tax Consultant will help you save time and provide effective solutions for your needs.

While we provide tax preparation services through three convenient locations in the Maryland and Northern Virginia region, we are able to file state tax returns for all 50 states. In fact, we have many clients that have been with us for over 30 years, some of which have moved to dozens of different states across the country and continue to use our services every year.

For fast service with your tax preparation needs, call (410) 549-2378 today or contact us online for quick answers to your questions, to schedule an appointment, or for additional information on emailing, mailing, or faxing your information.

E-Filing

Don’t wait until the last minute! New clients can save on our tax preparation services with our $140 special offer.

In 2006, a new record was set with over 73 million tax returns filed electronically through the IRS e-file system. There are many benefits to e-filing which include:

- Timely arrival of your return

- Avoiding long lines at the Post Office

- Accuracy and efficiency

- 48 Hour Confirmation by the IRS your return has been received

- Electronic payment options for taxes owed

- Faster refund checks!

Shapiro Tax Consultant is an authorized IRS e-file Provider. This allows us to file your return electronically to the IRS for processing. The process is seamless and efficient. Once your tax return is prepared, it is electronically sent to the IRS. When the IRS receives your return, it is automatically checked by computers for errors or missing information. If there is an error or missing information, your return is sent back for clarification and resubmitted. Within 48 hours of submission of your return, the IRS sends confirmation of acceptance for processing which is your proof of filing.

Refunds and Taxes Owed

If you are due a refund, it typically takes only about five to ten days to receive if you use direct deposit. If you owe money, you can take advantage of the electronic payment options offered by the IRS to assure timely payment.

E-Filing of State Returns

Shapiro Tax Consultant can e-file your state tax returns for both Maryland, Virginia, and many other states. Over 35 states currently offer e-filing which works in a similar manner to the Federal IRS system. (Additional E-Filing Charges Apply)

For fast service with your tax preparation needs, call (410) 549-2378 today or contact us online for quick answers to your questions, to schedule an appointment, or for additional information on emailing, mailing, or faxing your information.

Trust and Estate Tax Preparation Services

Don’t wait until the last minute! New clients can save on our tax preparation services with our $140 special offer.

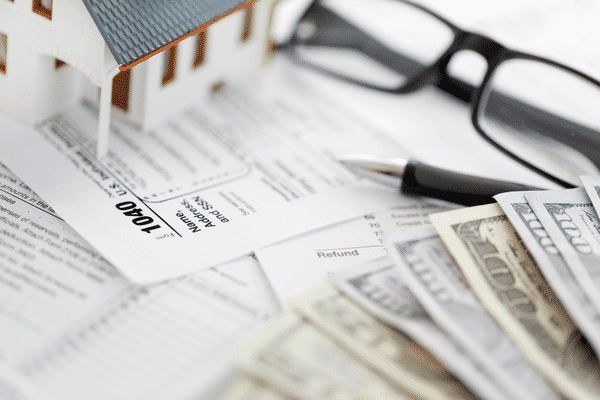

Estate taxes and estate tax filing may be required upon your death. Currently, most simple estates that typically consist of cash, stocks, and easy-to-value assets which have a total value of less than $2,000,000 (in 2006-2008*) do not require the filing of an estate tax return. For estates valued over $2,000,000 (in 2006-2008*), the Estate Tax is basically a tax on your right to transfer property at your death.

* In 2009 the estate tax exemption will increase to $3,500,000.

At your death, the gross estate value minus qualified deductions will determine whether an estate filing and tax payment are required. There are many different variables that can determine the value of your estate, which not only include the value of all property at your death but can also include:

- The value of the property you sold or transferred within 3 years of your death.

- Insurance proceeds or annuities payable to your estate or heirs.

- Trusts that you previously established.

Additionally, qualified deductions to the value of your estate may include:

- Funeral expenses

- Marital deductions

- Debts owed at the time of your death

- Charitable deductions

- Administration expenses of your estate.

Trusts

The term “trust” is used by the IRS as a declaration whereby a trustee, or trustee, takes title to the property of another to protect or conserve it for the beneficiaries. Trust administration includes filing taxes, distributing assets to beneficiaries, and more.

Contact us by phone at (410) 549-2378 today or contact us online for quick answers to your estate and trust tax questions, to schedule an appointment for our estate and trust tax preparation services, or for additional information.

Looking to file your taxes?

Speak to one of our experts today!